Contractor Financials, a company dedicated to making financial services easy for contractors, has run an information-gathering campaign designed to highlight the effects on the mortgage market after Brexit.

With house prices up 5.2% from 2015, this article explores a range of different angles and scenarios to provide insight for those feeling concerned following the Brexit decision. This insight is provided through quotes and predictions from industry professionals and influencers who work in the financial world day after day, within banks, mortgage lenders, or financial advisors.

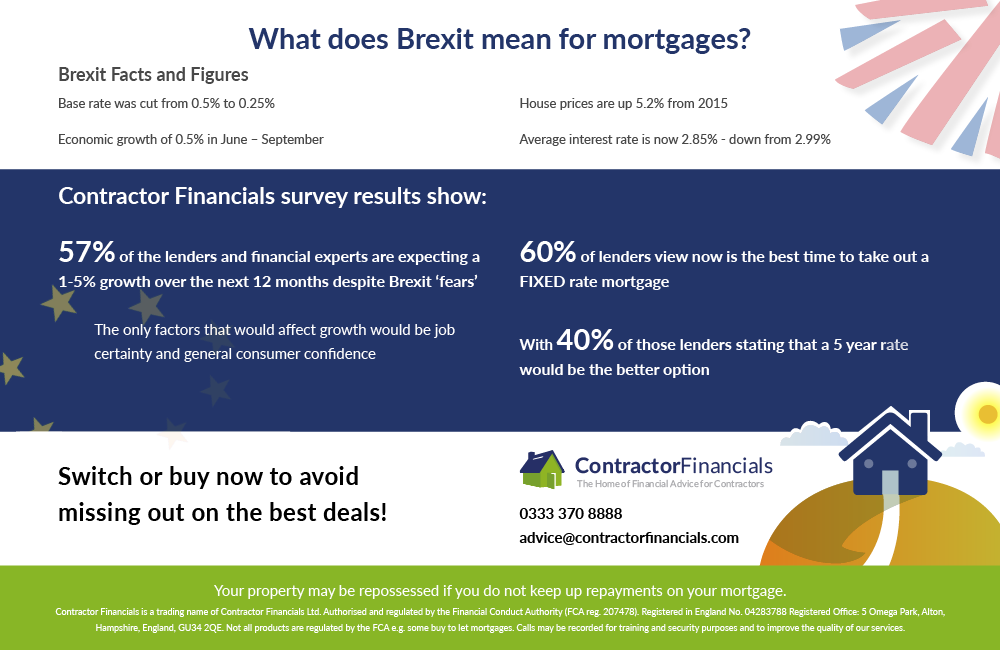

Key facts:

- *57% of the lenders and financial experts are expecting a 1-5% growth over the next 12 months despite Brexit ‘fears’.

- 60% of lenders questioned viewed now was the best time to take out a fixed rate mortgage.

- The cost of borrowing has fallen since the vote, with the average mortgage now repaid at a rate of 2.85%- down from 2.99%.

With first-hand data collected from the field, this information provides a unique overview of the property market, focusing on property investment and mortgages.

Whether you’re a first-time buyer considering your options, a property developer looking for an opportunity, or a concerned landlord, this article has the valuable information you need to calm your nerves and help you make informed decisions moving forward. For more information on the findings, check out the full article at https://goo.gl/3E45Z4.

About the company – Contractor Financials was founded in 2001 after identifying a gap in the market for financial help aimed at freelancers and contractors. Since then, they have helped over 22,000 contractors achieve their financial goals, offering a one-stop-shop for financial services including pensions, mortgages, financial protection and investment advice